As an employer, you’re required to adhere to certain federal reporting requirements. If you fail to follow IRS guidelines, you’ll get flagged, and it’s a great way to get yourself “randomly selected” for an audit.

With a 1099-MISC, you need to report contractor income just like you do for employee income. The only difference is that you don’t have to withhold taxes on behalf of a contractor. This means that the IRS needs your help figuring out who should be reporting 1099 income.

The IRS wants that tax income, so make sure you don’t get in the way by not understanding what your obligations are.

When Is It Appropriate to Submit a 1099-MISC

First, make sure that your contractor fills out a W-9 form BEFORE they get paid—they’ll have a lot less incentive to do paperwork once the job’s done and they’ve received full payment.

If all the following requirements are met, you’ll need to issue a 1099 to the IRS and the contractor at the end of the year.

- You’ve employed an independent contractor and paid them more than $600 during the tax year.

- The payment must be made in relation to your business activities.

- The business was a sole proprietor or an LLC being taxed as a sole proprietor.

Tax Repercussions of the 1099-MISC

As an client, you only need to fill out and submit the paperwork. The contractor is the one required to pay taxes on the money earned and reported on the 1099-MISC form. Since they are a contractor and not an employee, they pay both sides of the tax liability.

Not only is the client not on the hook for any taxes, but the client isn’t required to withhold any taxes on behalf of the other party like it would for a W-2 employee.

With the 1099-MISC, the documentation ensures that the payment is reported to the IRS. In return, this gives the Internal Revenue Service the information needed to hold the contractor accountable.

How Can I Report Income from a 1099-MISC?

If you’ve received a 1099-MISC from a previous client or employer, you’ll be required to report that income to the IRS. There are several ways to do so and the proper course of action will depend on your employment status or business structure. Here are the most likely situations.

If you are a sole proprietor:

Schedule C, along with any allowable business expense deductions. The total from the Schedule C will show up on your personal tax return as an income line items.

If you are an LLC taxed as a sole proprietor:

From a tax perspective, there is no difference between how you report 1099 income as a sole proprietor and how you report as an LLC taxed as a sole proprietor. The only tax implications that you need to think about are the additional business expenses that you might be able to deduct as an LLC that you weren’t able to deduct as a sole proprietor. For example, an LLC can lease personal assets from you.

If you are an LLC taxed as an S corporation:

You shouldn’t receive a 1099-MISC income statement for work done as a LLC that is electing to be taxed as an S-Corp. If you get a 1099 for that LLC, you’ll need to let your client know that they filed a 1099 in error because S-Corps issue their own income statements in the form of a K-1, of which the IRS also get a copy. You’ll want to make sure to clear this up, because the last thing you want is to get double taxed for the work that you’ve done.

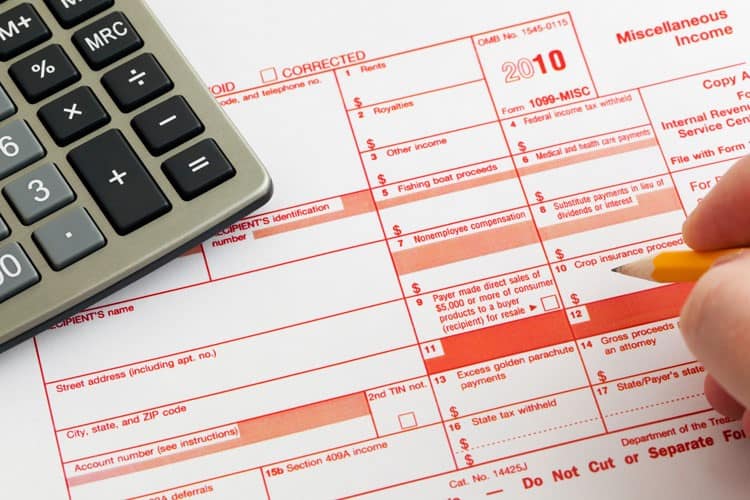

Paperwork Needed to Fill Out 1099-MISC

Once you determine that a 1099-MISC is necessary, you’ll need to start gathering data that is required for the completion of the form. It is crucial to be precise and thorough, when you are completing the form to avoid any potential mishaps.

When you agree to hire someone for contract work, you’ll need to first obtain their personal information, such as their name, physical address and social security number. This is all information that they give you when they fill out the W-9 form.

The 1099-MISC is a simple form to complete. You just tally up the total amount paid to the independent contractor or self-employed individual throughout the year. There’s just one number. You don’t need to worry about net or gross like you would with an employee. Easy, right?

The Importance of Reporting Income on a 1099-MISC

As a taxpayer, you are probably already aware of the fact that you need to report wages, salaries, interests, tips, and dividends on your taxes. With that being said, there are a lot of other forms of income that are often overlooked.

Some of these include side jobs, bartering incomes, contest winnings, awards, and gambling proceeds. Why is it important to report all of these incomes? The answer is simple really, as the IRS considers all income that you receive throughout the year as taxable income. This can even include property or services that are earned, won, or gained through any means.

However, there are some exceptions to this law through which you can be exempt from reporting income. Another major misconception that taxpayers make is that, if they do not receive a 1099-MISC form, or if their income is under $600, there is no need to report this income. This is not true and any form of income, regardless of the amount, needs to be reported to the IRS.

Remember Al Capone? They got him on tax evasion of all things. You don’t want to be that guy.

How To Find Additional Assistance

Tax time can be incredibly frustrating. There is a good chance that you’ll run into speed bumps along the way. If so, you should realize that the IRS is always willing to help you do things the right way.

You’ll likely be able to find the answers on their help website, or you can call their help hotline at (866) 455-7438.