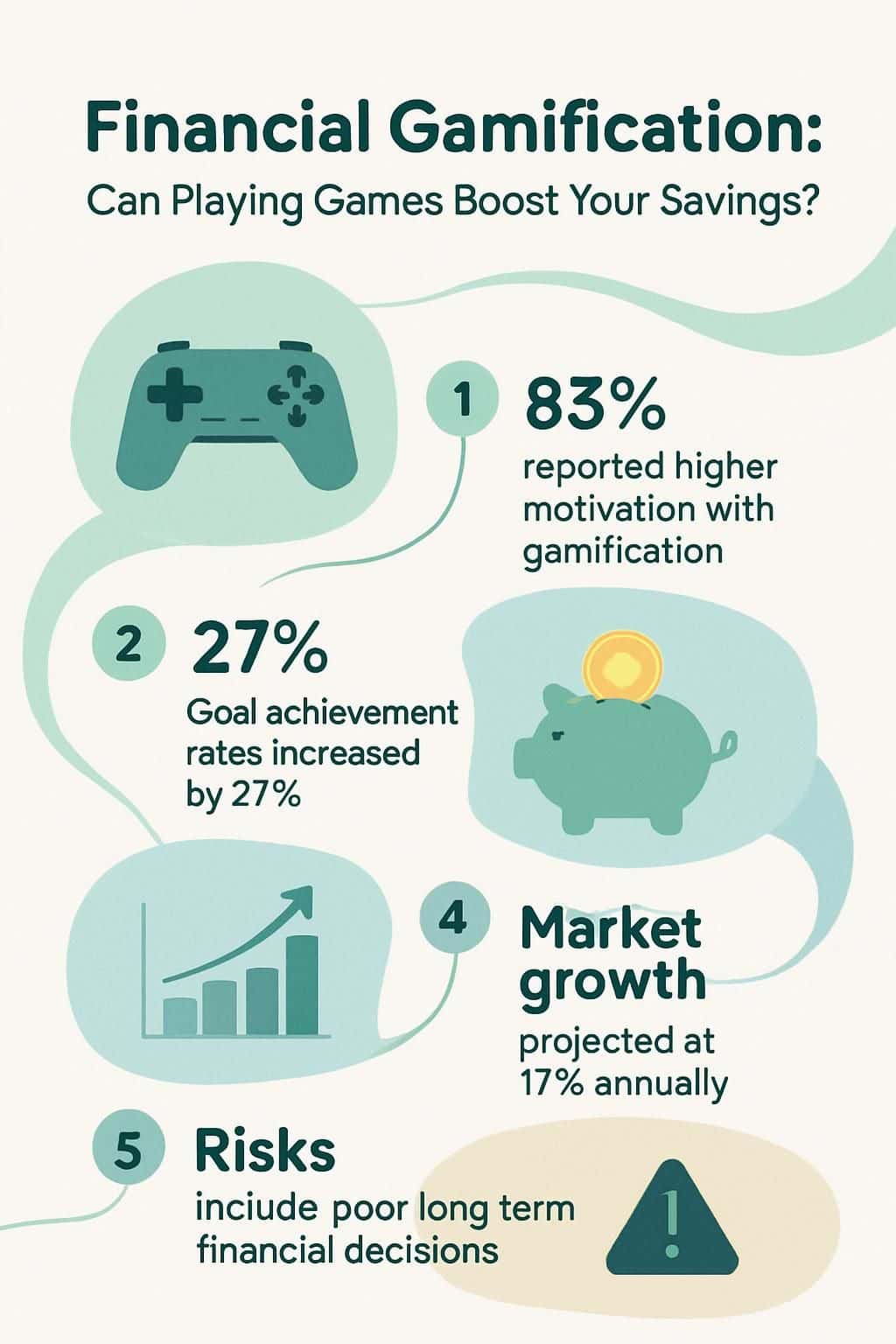

Are you tired of struggling to stick to your financial goals or boost your savings? A recent study found 83% of people feel more motivated when tasks are turned into games—a method known as financial gamification.

This post will show how adding rewards, challenges, and progress tracking can help improve your saving habits and make money management fun. Read on to learn how playing games might lead you toward better personal finances.

Key Takeaways

Financial gamification makes saving money fun by using rewards, challenges, badges, and progress tracking. This helps people stay engaged in budgeting and reach savings goals faster. For example, fintech apps like Monobank award badges for timely payments; Mint uses leaderboards to let users compete with peers.

Turning financial tasks into games can boost motivation and improve financial literacy. A 2019 survey found that 83% of workers felt more motivated at their jobs when training included game-like features. A study involving 2,220 students also showed online finance games raised money skills significantly compared to traditional lessons.

Gamified budgeting tools show positive results: Progress tracking visuals can increase goal achievement rates by up to 27%. Common examples include monthly “no-spend” challenges or “round-up” apps that turn small change from card purchases into big annual savings (over $700).

Too much focus on gaming incentives has risks: Users might chase quick wins over sound long-term decisions—spending beyond budgets just for cashback points or higher leaderboard ranks. Researchers continue studying these downsides as reliance on gamified mechanics could harm overall financial health.

Financial gamification will likely expand fast in the future—expected market growth is 17% each year through 2028, reaching nearly $49 billion. By around 2025, AI-driven money management games offering personalized saving tips based on user behavior will become common alongside advanced cloud technology updates.

Table of Contents

What is Financial Gamification?

Financial gamification uses game elements like rewards, competition, and progress bars to make managing money enjoyable. First named in 2002, it became popular over the last ten years for better user engagement in areas such as digital banking apps and financial planning tools.

Apps such as Monobank or Revolut apply this method by giving badges when you hit savings goals or rewards through cashback programs. It activates your brain’s pleasure center similar to fitness trackers rewarding exercise milestones—or even the buzz achieved from playing on Bitcoin casinos.

This helps form strong financial habits around budgeting, saving, debt reduction, and boosts overall financial literacy without stress or boredom.

Key Principles of Financial Gamification

Games grab our attention through fun stories, friendly competition, and clear goals that push us to save more. Using digital banking solutions with playful features boosts customer engagement and leads users into a rewarding flow state.

Storytelling and Narrative

Storytelling can make financial gamification fun and real. Relatable characters who face debts, expense tracking troubles, or saving for health costs grab men’s attention through empathy.

Strong visuals and audio elements in mobile apps add depth to the user experience. Compelling conflicts, like repaying a credit card debt or handling sudden expenses, reflect issues men know well—and spark curiosity.

A study on customer engagement found that users stay involved longer when stories mimic their own money struggles in digital banking solutions.

Stories make finance personal—each character’s struggle turns boring numbers into goals worth chasing.

Progress Tracking and Feedback

![]() Progress tracking helps men stay focused on savings goals. Digital tools, such as budgeting apps and mobile banking platforms, use visuals like progress bars or leaderboards to deliver instant feedback on your financial performance metrics.

Progress tracking helps men stay focused on savings goals. Digital tools, such as budgeting apps and mobile banking platforms, use visuals like progress bars or leaderboards to deliver instant feedback on your financial performance metrics.

Studies show that gamified tracking can boost goal achievement by up to 27%, just as families using activity trackers became more active daily. Real-time updates from fintech companies let you quickly see where your cash flows each month and help pinpoint spending habits that hinder customer retention of savings plans.

Immediate feedback through a gamified approach motivates users to adjust behaviors fast, reducing the risk of debt settlement issues or slipping into unwanted bankruptcy situations down the road.

Rewards and Achievements

Rewards and achievements tap into men’s natural desire for success. Many budgeting apps, like QuickBooks or financial tools from Truist Bank, use badges or cashback rewards to boost user engagement.

Fintech companies have found that clear incentives—such as discounts, bonus points, or special offers—motivate users to meet their saving goals faster and reduce debt sooner. Men get satisfaction from hitting targets set by goal-setting features in mobile applications like Venmo or ApplePay; this sense of accomplishment builds better habits over time.

For instance, opening a secret bank account can offer additional savings perks worth reaching milestones for—and personally speaking, achieving these rewarding steps makes the whole experience more enjoyable.

Competition and Challenges

Competition creates a strong push to reach financial goals. Leaderboards, badges, and rankings encourage users to save more, spend wisely, and cut debt faster. Apps like Mint use competition by showing men their progress against peers.

Daily rewards programs add challenges that fuel motivation through steady progress tracking. Financial apps even employ behavioral nudging—leveraging basic human psychology—to boost customer engagement and retention in gamified saving journeys.

What gets measured gets improved. – Peter Drucker

Yet too much competition has risks as well. Over-reliance on game mechanics can lead users into risky cash decisions or turning personal finance into unhealthy rivalry. Some men might chase high leaderboard ranks at the cost of sound money moves or careful goal setting with clear KPIs.

Striking balance between healthy challenges and sustainable habits remains key for successful gamification in personal finance tools today.

Let’s look next at how these methods impact your finances directly: “- Benefits of Financial Gamification on Personal Finance”.

Benefits of Financial Gamification on Personal Finance

Financial gamification gets men excited about financial planning by turning savings goals into fun achievements they enjoy chasing. With interactive budgeting apps and debt-tracking challenges, it motivates users to take control of their money habits every day.

Increased Engagement in Financial Planning

Men often find traditional financial education dull, but gamification makes it exciting. A 2019 survey showed that 83% of workers using gamified training felt more motivated at their jobs; this motivation can also boost your engagement in personal finance.

Progress tracking tools—such as budgeting apps with clear progress bars and savings challenges—keep you involved every step along the way. Cashback rewards, badges, referral programs, and friendly competition all help increase customer satisfaction and loyalty by turning money management into a fun game rather than a boring task.

Improved Saving Habits

Gamification makes personal finance feel more like a game and less like hard work. Budgeting apps now have creative challenges, such as a no-spend month or limiting spending on food, to help men build effective saving habits.

Round-up apps automatically transfer spare change from daily debit card transactions into savings accounts, turning small amounts into big savings effortlessly. Other software applications set monthly challenges that gradually increase by $10 each month; starting at just $10 in January adds up to an impressive $780 saved by December.

Apps using storytelling, achievements, and cash back incentives encourage users to stay motivated with clear progress tracking. These engaging methods boost user experiences through improved UI design and relevant feedback from tools like Google Analytics, helping men track financial goals clearly while fostering customer loyalty over the long term.

Enhanced Financial Literacy

Playing finance-based games can greatly strengthen financial literacy. A recent study with 2,220 students from four countries found that online games improved their money skills by 0.313 standard deviations more than traditional methods did.

Budgeting apps that include progress tracking bars or cashback rewards programs help people learn smarter money habits and understand loss aversion better than plain instruction does.

Many fintech companies now work closely with policymakers to boost financial security for vulnerable groups through strategic use of gamifying tools like leaderboards, badges, and challenges.

Mastering these game principles in personal finances prepares you to tackle bigger targets—such as cutting back debt—and that’s the next key benefit we’ll explore together.

Motivation to Reduce Debt

Motivation to reduce debt often comes from clear progress tracking and celebrating small wins. Debt reduction apps use progress bars, graphs, and visuals, turning repayments into an exciting challenge men can enjoy.

These gamified interfaces show realistic payoff plans in a simple way, helping users visualize their financial goals clearly. Users build strong commitment by marking important milestones in their repayment plan or earning badges for extra payments—even small ones—toward debts like credit cards or personal loans.

A goal properly set is halfway reached. – Zig Ziglar

Debt-tracking software that shows remaining balances shrinking each month increases men’s determination to stick with financial strategies long term. Fintech companies such as Truist Financial Corporation offer tools combining storytelling and competition elements through leaderboards or reward systems tied directly to savings achieved or debt reduced.

Gamified budgeting platforms help men stay actively focused on reducing outstanding balances instead of casual consumer choices that hinder return on investment efforts toward building wealth and security.

Let’s check out how real-life examples put fun into handling money.

Examples of Gamification in Personal Finance

Mobile finance apps use clear visuals, goal-based challenges, interactive features—the same tools video games offer—to make saving money and budget tracking fun; curious how these design ideas work in practice?

Budgeting Apps with Progress Bars

Budgeting apps like Mint sync with your bank accounts to help organize funds clearly. They use progress bars, similar to game levels, which show how close you are to meeting spending limits and saving goals.

From first-hand experience, these tools boost customer engagement by making routine money tasks feel more dynamic. Many fintech companies include such gamification in their business strategy because the playful visual feedback drives motivation for better cash flow management and reduces customer churn.

Savings Challenges and Goals

Progress bars in budgeting apps are just one way to motivate better money habits. Savings challenges and clear financial goals offer another practical approach for men who like competition and structure in their personal finance journeys.

Popular strategies include rounding up purchases through fintech company apps, turning spare change into savings with each swipe of the card. Another effective tactic is tackling a no-spend month, limiting expenses strictly to basic needs—cutting out extras such as dining out or buying new gadgets—to quickly boost your saving balance.

Year-long savings challenges can also keep motivation high by setting specific monthly targets toward a larger goal, such as paying off debt or investing more money into stocks or securities.

Men focused on customer experience understand that clearly defined objectives help maintain momentum in financial planning; goals give purpose and direction to your spending decisions.

For those interested, small side hustles might further enhance savings programs; find creative ways to make extra money over weekends and speed up progress toward even bigger rewards.

Cashback and Rewards Programs

Cashback and rewards programs use gamification to boost savings, budgeting, and responsible spending. Standard Chartered Bank’s 2021 Twist & Win campaign is one clear example; it surprised card users with cashback on credit card payments, raising customer experiences and engagement in a big way.

Finances Online reports that companies using gamification methods see conversion rates rise by more than 700%, proving strong success in marketing and customer acquisition through these incentives.

Men interested in improving their finances can look for budgeting apps or retailers that offer reward points for sensible choices like lending less, cutting credit debt, or using investment advisers smartly.

Tools such as TurboTax also reward good financial practices by giving discounts or special deals when taxes are filed early. Using these rewards platforms not only increases motivation but makes the process of saving money practical and enjoyable too.

Leaderboards and Badges

Leaderboards stimulate competition and clearly track individual achievements, making financial goals feel exciting. Apps like Revolut use leaderboards to show rankings among friends or family, even offering monetary rewards for top savers.

Badges give users visual signs of success, fostering loyalty and encouraging exploration in financial apps. For example, Monobank in Ukraine awards badges for timely transactions and includes mini-games that keep users involved.

These techniques have helped Monobank reach over 8 million active users by turning personal finance into playful motivation rather than a dull task.

Challenges of Financial Gamification

While gamified budgeting apps may boost your interest, too much focus on rewards can lead to careless spending. Also, chasing badges and leaderboards might distract you from good long-term saving habits.

Over-reliance on Game Mechanics

Relying too much on game mechanics can lead men to chase quick wins over long-term money goals. Points, badges, and leaderboards feel rewarding right away but might not encourage good saving habits or careful budgeting.

In my experience with cashback and rewards programs in the retail industry, I ended up spending more just to earn extra points and bonuses. Financial scientists are still researching how gamification shapes financial behavior; sometimes it can push people into risky moves or decisions that could harm their finances later on.

Men who lean heavily on apps focused solely on incentives may neglect important aspects like regulatory compliance, avoiding financial mismanagement and reducing debt.

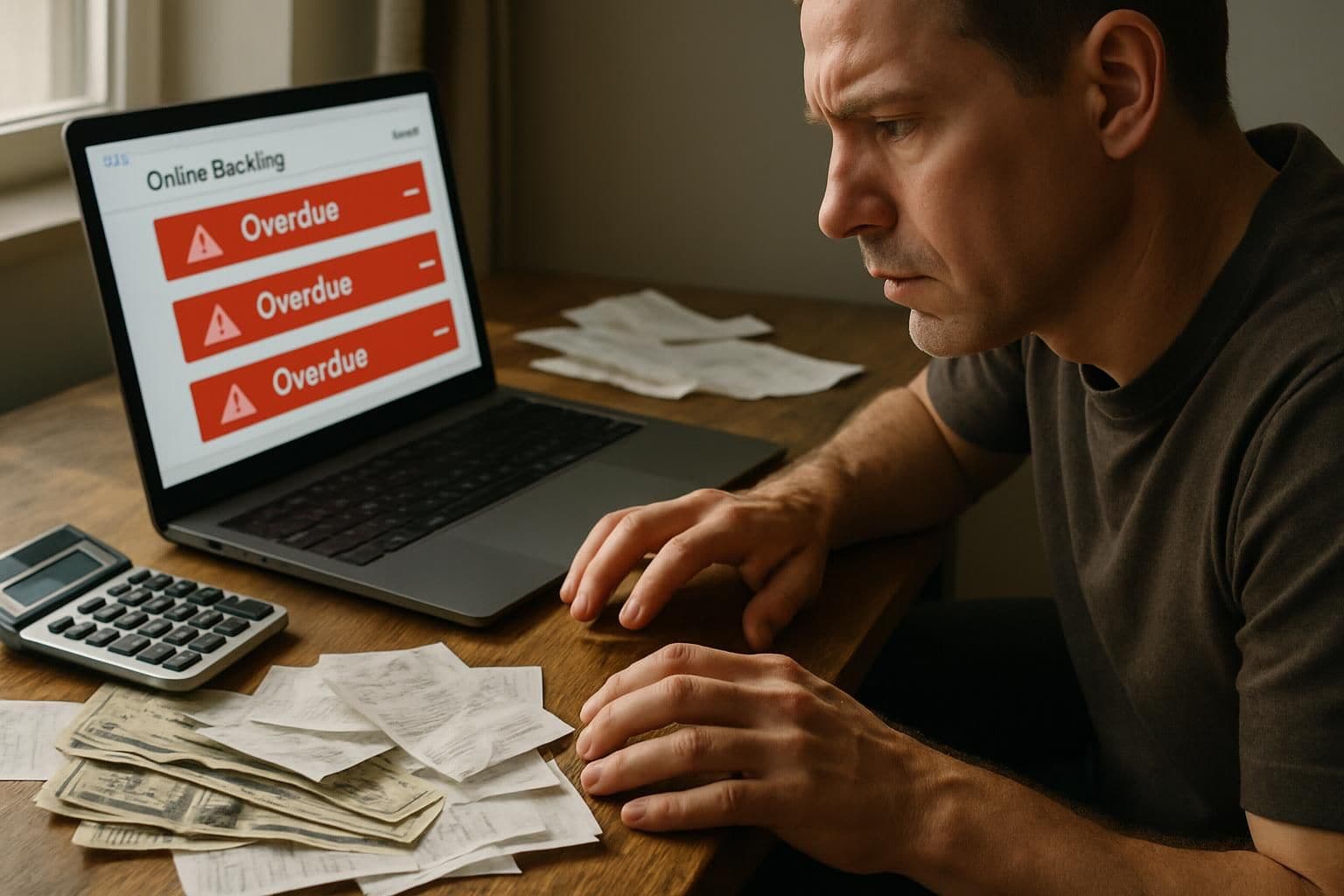

Risk of Financial Mismanagement

Gamified financial apps can lead some men into risky behavior, as game mechanics may promote short-term gains over smart long-term planning. Competition and incentives like cashback rewards or badges might encourage excessive risk-taking and spending beyond set budgets.

Overuse of progress tracking or leaderboards in budgeting apps could push users to chase quick wins instead of stable financial health, causing debt rather than reducing it. Scientists continue to study how gamification affects men’s saving habits and overall money management, as an unhealthy dependence on these methods remains a real concern for personal finances.

How Will Financial Gamification Evolve in 2025?

Financial gamification will grow faster than ever in 2025, driven by artificial intelligence (AI), cloud-based solutions, and large financial platforms. The market is set to expand at a rate of 17 percent annually and should hit $48.72 billion by 2028 due to innovations that attract more men into personal finance.

AI-powered apps can soon give personalized savings goals based on habits or spending patterns—like your very own MrBeast challenge for budgeting or debt reduction. This means smarter gaming mechanics created through agile software development lifecycles that involve UI/UX designers, programming experts, and even collaborations with brands offering incentives like cashback programs.

Cloud technology will provide cheaper updates for financial games, making it easy to offer fresh options without costly reprogramming from scratch each time. Mega financial platforms may merge services such as investing advice, insurance coverage protected through SIPC standards, or managing loans compliant with the NMLS rules—all made fun using engaging visuals and clear progress tracking features built for limited English proficiency users too.

Competition could be fierce between big banks eager to capture target audiences looking for simple yet enjoyable ways toward better saving habits while helping lower cardiovascular risks related directly to stress over unpaid debts—a true blend of fun gaming rewards mixed right alongside real-life value propositions focused on men’s wellness needs beyond just cash alone!

People Also Ask

What exactly is financial gamification, and how does it help boost savings?

Financial gamification uses game-like technologies to encourage saving money. It makes managing finances fun by offering incentivized rewards when you reach your goals.

Can playing games really change spending habits for the better?

Yes, studies show that gamification can positively influence behavior—like increasing altruism or helping people save more consistently—by making good financial choices enjoyable.

How can financial gamification support efforts against non-communicable diseases?

Gamified apps often promote healthy lifestyle choices alongside smart spending habits. By rewarding users who make healthier decisions, these tools help lower risks linked to non-communicable diseases while improving overall well-being.

Is there a difference between “gamificaiton” and “gamificiation,” or are they just spelling mistakes?

Both “gamificaiton” and “gamificiation” are common misspellings of the correct term: “gamification.” The proper spelling refers clearly to using game-based methods in finance to motivate better saving behaviors through engaging activities and incentives.

References

https://www.truist.com/money-mindset/principles/mind-money-connection/how-to-gamify-finances

https://www.tandfonline.com/doi/full/10.1080/17530350.2021.1882537

https://www.miquido.com/blog/gamification-in-financial-services/ (2025-01-22)

https://www.forbes.com/sites/sushmadaggubati/2025/01/21/gamification-shaping-financial-engagement-in-the-digital-era/ (2025-01-21)

https://www.sciencedirect.com/science/article/pii/S0147596724000441

https://smartico.ai/blog-post/gamification-in-financial-management (2023-07-11)

https://www.smartico.ai/blog-post/gamification-in-personal-finance

https://www.smartico.ai/blog-post/gamification-in-financial-management

https://bigthink.com/neuropsych/gamification/

https://www.purrweb.com/blog/gamification-in-banking-features-benefits-costs/ (2024-08-13)