Ever feel like you can do everything right, save money, invest, work hard, and your net worth still gets pushed around by the stock market?

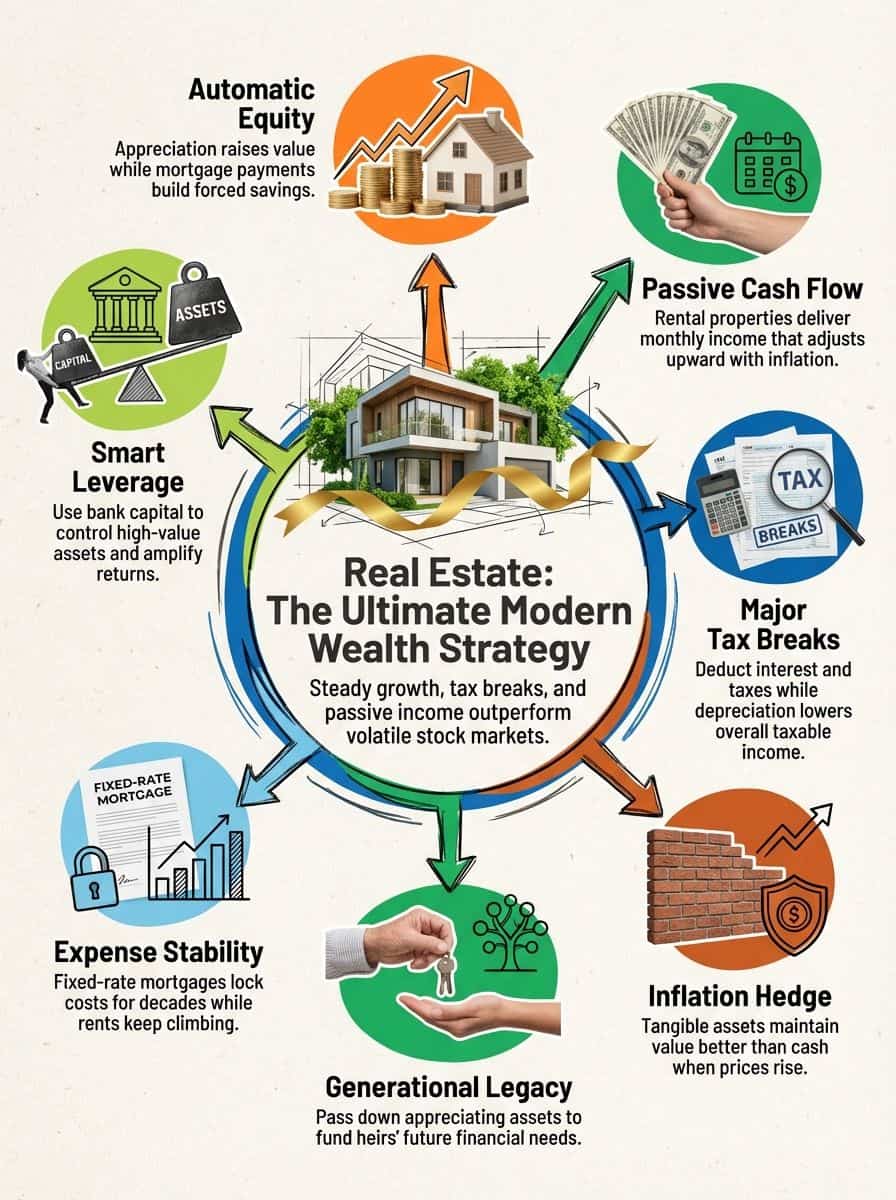

That’s why I like real estate ownership for modern men who want steady wealth, not whiplash.

In this guide, I’ll show you how home equity, rental property cash flow, smart financing, and real-world tax advantages can work together to build passive income and generational wealth, without pretending it’s effortless.

Key Takeaways

U.S. mortgage holders carried about $17.6 trillion in home equity entering Q2 2025, and rising prices can add to that equity as you hold and pay down your mortgage.

Entering Q2 2025, homeowners had about $11.5 trillion in tappable equity, averaging roughly $212,000 per borrower, which can be accessed with HELOCs or cash-out refinancing if the numbers work.

Depreciation for rental property is typically spread over 27.5 years, and when you combine it with deductible operating expenses, it can reduce taxable rental income.

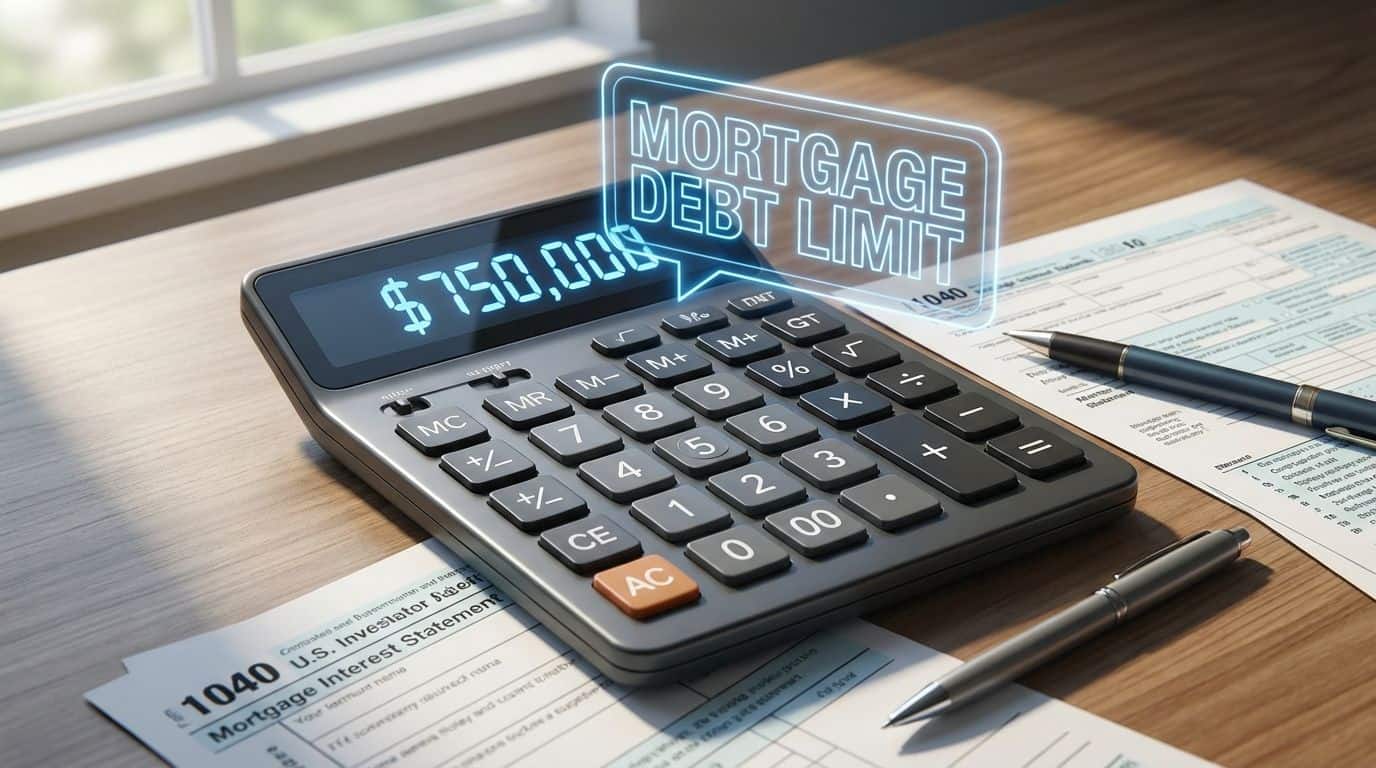

For many filers, deductible mortgage interest on newer loans is limited to $750,000 of mortgage debt, and the SALT limit for itemizers can materially affect how valuable property tax deductions are year to year.

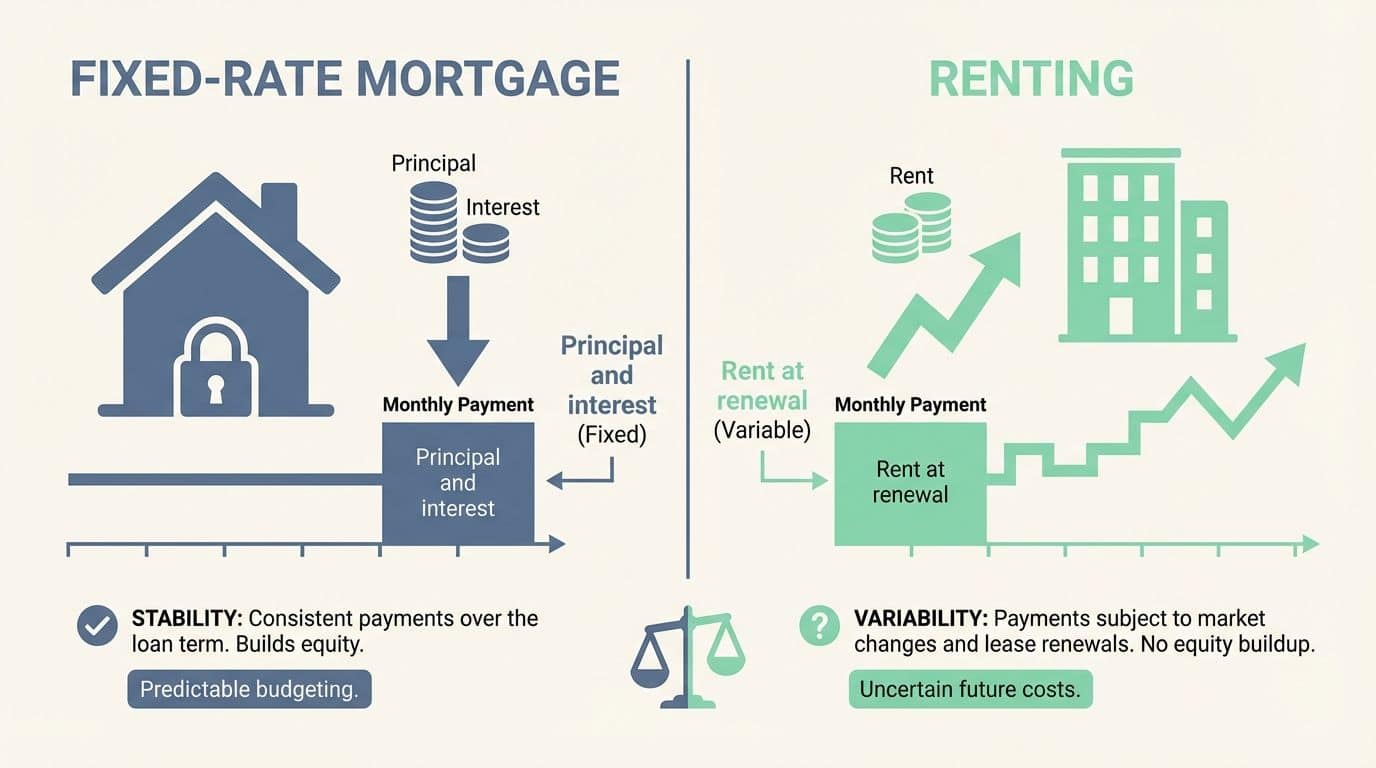

A fixed-rate mortgage can stabilize your principal-and-interest payment, while rents often change over time. For context, Freddie Mac reported the average 30-year fixed rate at 6.15% as of December 31, 2025, which matters when you model future mortgage payments.

Table of Contents

Building Wealth Through Real Estate Ownership

If you buy right and hold, real estate ownership can build wealth in two ways at the same time: the property can appreciate, and your mortgage payments can steadily reduce your mortgage debt.

That combo turns a home or investment property into a long-term savings engine. You keep living your life while your equity stake grows in the background.

The move most guys miss is the “second phase”: once you’ve built enough home equity, you can use tools like a home equity line of credit or a cash-out refinance to fund renovations, consolidate higher-interest debt, or make another real estate investment, as long as the cash flow and risk stay under control.

- Buy with a margin of safety: prioritize neighborhoods with durable demand, not hype.

- Stress-test the payment: include taxes, insurance, and a maintenance reserve, not just the mortgage loan payment.

- Keep an equity cushion: don’t borrow your way down to a razor-thin buffer.

- Plan the exit: hold long enough that selling fees and closing costs don’t eat the win.

How does property value appreciation build wealth?

Home equity grows quietly, then changes your life.

Property value appreciation builds wealth because it increases your market value while your loan balance shrinks. You’re stacking gains from two directions.

To see how real this is, the FHFA House Price Index reported U.S. home prices rose 4.5% from Q4 2023 to Q4 2024, and the S&P CoreLogic Case-Shiller National Index showed a 3.4% annual gain in March 2025. Those are national numbers, so your local real estate market will vary, but they’re useful for a reality check when you’re modeling returns.

Here’s the action step: don’t just “wait for appreciation.” Create it, and protect it.

| Value move | What it does for you | How to use it |

|---|---|---|

| Buy below comparable sales | Gives you instant equity potential | Look for cosmetic fixes, dated finishes, or poor marketing photos |

| Target high-ROI improvements | Turns upgrades into measurable resale value | Use a short list of proven projects, not personal taste |

| Protect the asset | Prevents equity loss from deferred maintenance | Budget annually for maintenance and repairs |

If you want numbers for upgrades, Zonda’s 2025 Cost vs. Value Report highlighted several projects with unusually strong “cost recouped” figures, including garage door replacement (267.7%) and a minor kitchen remodel (112.9%), which is a helpful way to avoid renovations that feel fun but don’t pay you back.

And if you’re buying a fixer, financing can matter as much as design: Fannie Mae’s HomeStyle Refresh program lets borrowers finance renovation costs up to 15% of the as-completed appraised value, which can be cleaner than juggling personal loans and credit cards when you’re trying to stabilize your cash flow.

For local options, see Gurr Luxury Properties for Heber City listings and market advice.

What is equity accumulation and how does it grow over time?

Equity accumulation is the gap between a property’s market value and your remaining mortgage balance. It grows when prices rise, when you pay down principal, and when you add value through smart improvements.

Here’s a simple example: if you buy at $400,000 and the home later appraises at $500,000, that’s a $100,000 equity gain before you even count any principal you’ve paid down.

The practical move is learning when to use equity versus when to leave it alone. A HELOC or cash-out refinance can be a powerful line of credit for investing or home repair, but it can also turn a safe asset into a fragile one if you over-borrow.

- Use equity for upgrades that raise value or durability: roofs, HVAC, and safety fixes can protect your resale and your rents.

- Use equity to reduce expensive debt: replacing high-interest credit card balances can improve savings and stability.

- Avoid borrowing for lifestyle spending: it raises your fixed expenses without raising your income.

- Model the worst year: ask, “If rents dip and repairs spike, can I still cover mortgage payments?”

One more protection: the CFPB’s Ability-to-Repay and Qualified Mortgage rules were built to limit risky features and push lenders to verify a borrower’s ability to repay. That helps, but it doesn’t replace your own budgeting and stress testing.

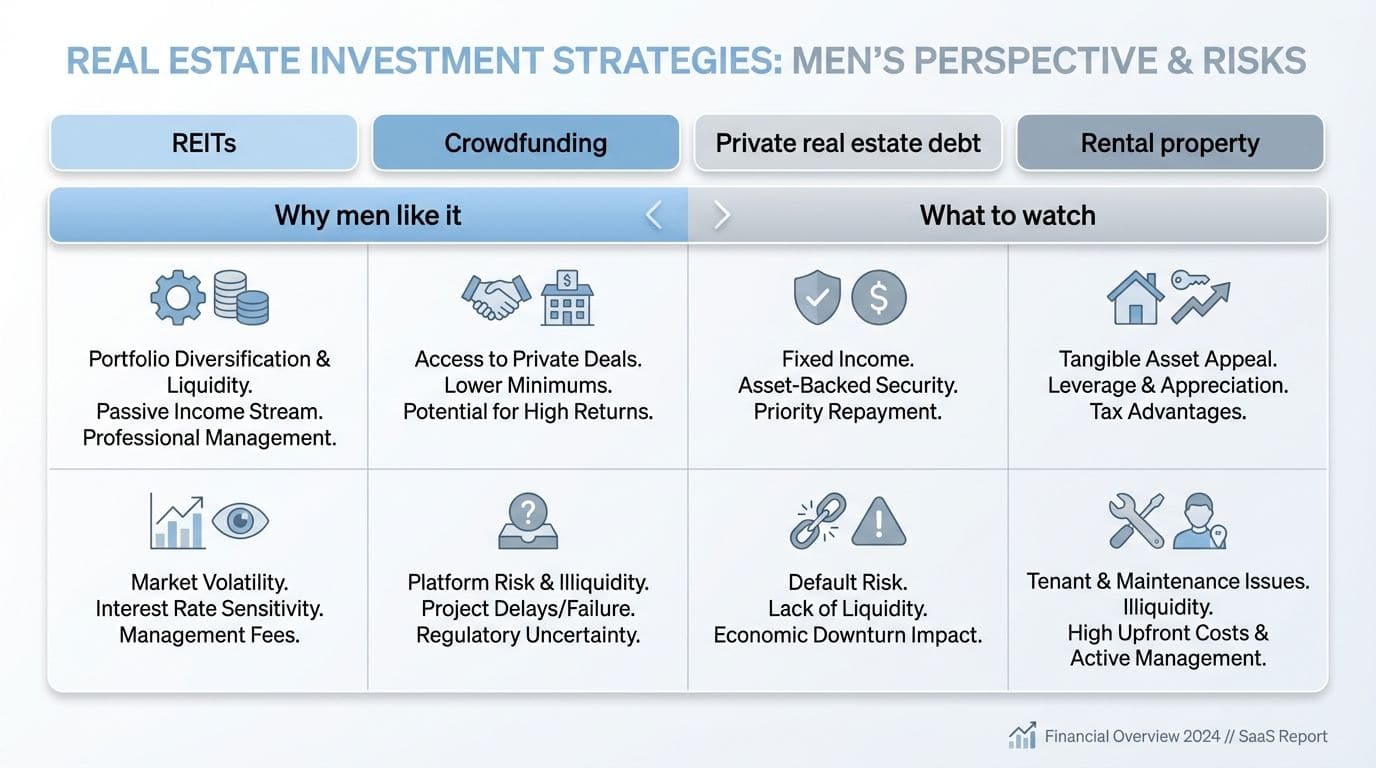

What are the best passive income opportunities in real estate?

If you want passive income without becoming a full-time landlord, you’ve got options. The best fit depends on how much control you want, how liquid you need the money to be, and how hands-on you’re willing to get.

Think of these as different “levels” of real estate investing, from fully passive to more hands-on ownership.

| Option | Why men like it | What to watch |

|---|---|---|

| REITs | Easy access, simple to diversify beyond one property | Stock-like swings, dividend taxes, and fees |

| Crowdfunding | Access to bigger deals with smaller checks | Illiquidity, platform risk, deal quality varies |

| Private real estate debt | More predictable returns, less tied to appreciation | Default risk, underwriting matters |

| Rental property | Best blend of control, tax benefits, and long-term upside | Maintenance, vacancies, and management time |

For REIT structure, the IRS rules for REITs require a dividends-paid deduction tied to distributing at least 90% of taxable income, which is one reason REITs can be appealing for income-focused investors.

How can rental properties generate steady income?

Rental properties can create steady income when the rent reliably covers your mortgage payments and your operating expenses, with room left over for savings and surprises.

What makes it “steady” is the system, not luck. You screen tenants well, you budget for maintenance and repairs, and you keep the payment structure predictable with fixed-rate mortgages whenever you can.

- Underwrite with real expenses: insurance, property taxes, utilities you cover, and a maintenance reserve.

- Budget for upkeep: Fannie Mae suggests a rule of thumb of 1% to 4% of your home’s value per year for maintenance costs, depending on the home’s age.

- Use a tenant-proof buffer: hold cash for vacancies and big-ticket items like HVAC and heaters.

- Track net cash flow monthly: treat it like a business, not a hobby.

For the “protect the downside” angle, homeowner insurance trends matter too. The Joint Center for Housing Studies at Harvard has highlighted how insurance premiums have risen sharply in recent years, so it’s smart to re-quote insurance at renewal and factor premium increases into your budget.

Read how to invest in real estate with 10k.

What should I know about short-term vacation rentals?

Short-term rentals can earn more per night, but they’re not automatically more profitable. You’re trading “steady” for “variable,” and your budget needs to handle off-season dips.

If you go this route, treat it like an operations business. Pricing, turnover, cleaning, guest communication, and local compliance all matter.

- Price with data: AirDNA is widely used to estimate occupancy, average daily rates, and seasonality.

- Automate smartly: tools like PriceLabs can automate dynamic pricing so you’re not guessing demand.

- Prevent double bookings: a channel manager or property management system can sync calendars across platforms.

- Check rules before you buy: zoning, permits, and local enforcement can change the entire return.

The biggest pitfall is buying a “perfect” vacation rental, then learning the city limits the number of nights, requires a license, or restricts non-owner-occupied rentals. Always verify local rules first, then run the numbers second.

Tax Advantages of Real Estate

Tax advantages are a big reason real estate can outperform plain savings and many financial investments. The goal is simple: legally keep more of what you earn so you can reinvest faster.

There are three buckets to know: deductible interest, deductible taxes and operating expenses, and depreciation. Then there’s the “exit plan,” capital gain rules, and what happens when you sell.

How do mortgage interest deductions work?

If you itemize deductions, mortgage interest can reduce taxable income on a primary home and (in many cases) a second home, within the limits for qualified residence interest.

One key update for planning: CNBC reported in July 2025 that the $750,000 cap on deductible mortgage debt was made permanent in 2025 legislation, instead of reverting after 2025. That’s a big deal for long-term financial planning if you’re buying in a higher-cost market.

- Itemizing matters: if you take the standard deduction, you don’t use this benefit.

- Loan date matters: limits depend on when the mortgage loan was originated.

- HELOC rules matter: per IRS guidance, interest is generally deductible only when the funds are used to buy, build, or substantially improve the home securing the loan.

A common mistake is treating tax benefits like “free money.” They’re real, but they should support a deal that already works on cash flow.

What are property tax deductions?

Property taxes can be deductible if you itemize. For a landlord, property taxes are usually part of deductible rental expenses, which is one reason rental property can be tax efficient when you track expenses cleanly.

One important update: IRS instructions for Schedule A for tax year 2025 describe a higher SALT deduction cap of up to $40,000 (and $20,000 if married filing separately), with income-based limitations that can reduce the cap but not below $10,000 ($5,000 if married filing separately). That change can affect how you think about buying in high property-tax areas.

- Keep clean records: save tax bills and proof of payment.

- Separate personal vs. rental: track investment property taxes in your rental bookkeeping.

- Expect escrow changes: if taxes rise, your mortgage payments can rise even if your rate is fixed.

Local rules vary. If you’re in California, check guidance from the Department of Financial Protection and Innovation and confirm details with your county assessor and a qualified tax pro.

How can depreciation benefit real estate investors?

Depreciation is a non-cash deduction that can reduce taxable income on an income-producing property, even when the property is generating positive cash flow.

For many residential rental properties, the IRS recovery period is 27.5 years. That’s why you’ll often hear investors say, “I made money, but my taxable income was low.”

- Use depreciation with a plan: it’s powerful for building passive income faster through reinvestment.

- Track improvements correctly: some upgrades get depreciated differently than the building itself.

- Know the exit: unrecaptured Section 1250 gain can be taxed up to a maximum 25% rate, so plan before you sell.

If you want to get advanced, talk with a CPA about cost segregation for certain properties. It’s not for every deal, but it can change after-tax returns in a meaningful way.

How does real estate act as an inflation hedge?

Inflation squeezes your savings when prices rise faster than your pay. Real estate can help because rents and home values often move over time, while fixed debt stays fixed.

If inflation is a slow leak in your budget, fixed-rate debt can act like a seal.

- Rents can reset: leases renew, and market rents can rise in strong demand areas.

- Replacement costs rise: when materials and labor get more expensive, existing homes often gain pricing power.

- Fixed payments stay steadier: a fixed-rate mortgage doesn’t change the way rent does.

Why do property values rise with inflation?

When inflation pushes up wages, materials, and construction costs, the cost to build new housing rises too. That can make existing homes more valuable, especially in markets with tight housing supply.

The practical move is to buy a property you can hold through inflationary periods. A short-term, thin-margin deal is fragile, while a well-located property with stable financing has room to ride out volatility.

- Prefer long-term fixed-rate financing when the payment fits your budget.

- Prioritize durable locations with job diversity and consistent demand.

- Protect the property with insurance and a maintenance plan so surprises don’t force a sale.

How can rental income increase over time?

Rental income can increase when demand rises, supply stays tight, or local incomes grow. Your job is to set rent responsibly, keep tenants longer, and avoid rent increases that cause expensive turnover.

Use a simple system: raise rents modestly at renewal when justified by the market, improve the unit in ways tenants will pay for, and keep your operating expenses predictable.

- Track market rent quarterly: don’t guess.

- Invest in retention: fast maintenance response can reduce vacancy time.

- Add value renters feel: in-unit laundry, reliable HVAC, and secure access often matter more than fancy finishes.

- Keep cash reserves: vacancy plus a big repair is the combo that breaks new landlords.

How can real estate help create generational wealth?

Generational wealth isn’t just about leaving “stuff.” It’s leaving options: housing stability, an income stream, and an asset your family can refinance, rent, or sell strategically.

Real estate can do that because it’s one of the few assets where leverage, tax benefits, and long-term appreciation can stack together, if you manage it well.

- Keep title clean: clear deeds, clean liens, and organized records make transfers easier.

- Teach the basics: rent collection, maintenance, insurance, and cash flow are learnable skills.

- Plan ahead: trusts, business entities, or beneficiary tools can reduce probate friction.

What are the benefits of passing down property?

Passing down property can lower housing costs for your heirs or give them a built-in income stream. It can also anchor a family in a stable area, which is a real advantage when housing affordability is tight.

If your goal is a smoother transfer, a Transfer on Death deed is one tool that can help in jurisdictions that allow it. A 2025 update from the American Bar Association noted that 32 U.S. jurisdictions permit real property to be transferred by a TOD deed.

- Lower probate friction: beneficiary-style transfers can reduce delays.

- More flexibility: heirs can live in it, rent it, or sell based on their needs.

- Inflation protection: housing and rents can rise over decades, which can shield family budgets.

How does home equity build a lasting legacy?

Home equity becomes a legacy when it turns into real options: college funding, down payments, business ventures, or a retirement safety net.

Tax rules can matter here too. IRS Publication 551 explains that inherited property generally receives a basis tied to fair market value at the date of death, which can reduce capital gain if heirs sell soon after inheriting.

- Write a one-page “property playbook”: who to call, where documents live, how to pay bills.

- Carry the right insurance: one uncovered loss can erase years of equity growth.

- Keep a maintenance rhythm: it protects value and keeps tenants longer.

Why does real estate offer stability and financial security?

Stability comes from predictable housing costs, real assets, and a plan for the unsexy stuff like maintenance, insurance, and vacancy.

If you get those right, real estate can feel less like gambling and more like a long-term wealth strategy you can actually live with.

It also pairs well with other financial planning tools. You can still own stocks and bonds, but real estate adds a tangible asset and a different set of tax benefits.

How does a fixed mortgage compare to rising rent costs?

A fixed-rate mortgage stabilizes your principal-and-interest payment. Rent can change year to year, which is why a fixed payment can feel like a financial anchor over time.

Here’s a simple payment example: a $300,000 30-year mortgage loan at 6.15% has a monthly principal-and-interest payment of about $1,827.68. This does not include property taxes, insurance, or HOA fees, which can be significant.

| Scenario | What stays stable | What tends to move |

|---|---|---|

| Fixed-rate mortgage | Principal and interest | Taxes, insurance, maintenance |

| Renting | Short-term flexibility | Rent at renewal, moving costs |

As a risk reminder, adjustable-rate mortgages can look cheaper at first, but they can change your payment later. Mortgage Bankers Association data discussed by Investopedia noted ARMs were about 45% of originations in mid-2005, then dropped sharply in the years after.

How does real estate protect long-term wealth?

Real estate can protect long-term wealth by creating a hard asset you can use in multiple ways: live in it, rent it, refinance it, or sell it when it fits your life.

But the protection only works when you run it like a business. That means guarding your credit score, keeping reserves, and treating insurance and maintenance as non-negotiable line items.

- Hold cash reserves: aim for vacancy and repair buffers, not just optimism.

- Know your selling costs: between agent fees and closing costs, selling can easily cost several percentage points of the sale price.

- Use leverage carefully: debt can amplify returns, but it also amplifies stress if income drops.

- Diversify within real estate: single-family, multiunits, and REITs each behave differently.

How Will Real Estate Investing Change in 2026?

If you’re investing in 2026, the biggest edge isn’t predicting mortgage rates perfectly. It’s building a flexible plan that still works when rates, rents, and housing affordability shift.

PwC and the Urban Land Institute report they interviewed over 500 individuals and received nearly 1,250 survey responses for Emerging Trends in Real Estate 2026. Their big theme is clear: operators who use better data and focus on resilient demand win.

- Niche properties are maturing: co-living and last-mile logistics are being treated more seriously, not like fringe bets.

- Data analytics are moving from “nice” to necessary: owners are using GIS, automation, and machine learning to reduce operating costs and improve pricing.

- Markets to watch: Dallas/Ft. Worth, Jersey City, Miami, Brooklyn, and Houston were highlighted as markets to watch for 2026 and beyond.

If you want a simple 2026 play: focus on deals that cash flow under conservative assumptions, then use technology and systems to protect that cash flow.

People Also Ask

What makes real estate ownership the ultimate wealth strategy for modern men?

Real estate ownership builds equity and steady rental income, it grows over time with long-term appreciation. Modern men can use leverage, tax benefits, and hands-on choices to speed up wealth creation.

How does owning property create passive income?

Rent, or rental income, pays you each month, it can cover the mortgage and then add cash flow, like a hired hand that works while you sleep.

Is real estate safer than stocks for building wealth?

Both paths carry risk, but property is a tangible asset you can manage and improve. You can raise rents, cut costs, or sell when value climbs.

How should a modern man start with real estate ownership?

Begin with one cash-flowing property, study market demand, and keep debt sensible. Use lenders smartly, learn from a local agent or mentor, and take small steps to build equity and passive income.