The Coronavirus pandemic has caused immeasurable damage to nearly all aspects of society. The virus took many lives, destroyed countless livelihoods, and drastically changed everyone’s routine. Everyone now has to wear masks, keep a significant distance between each other, and spend more time in isolation.

From the financial side of things, life is looking gloomier than ever.

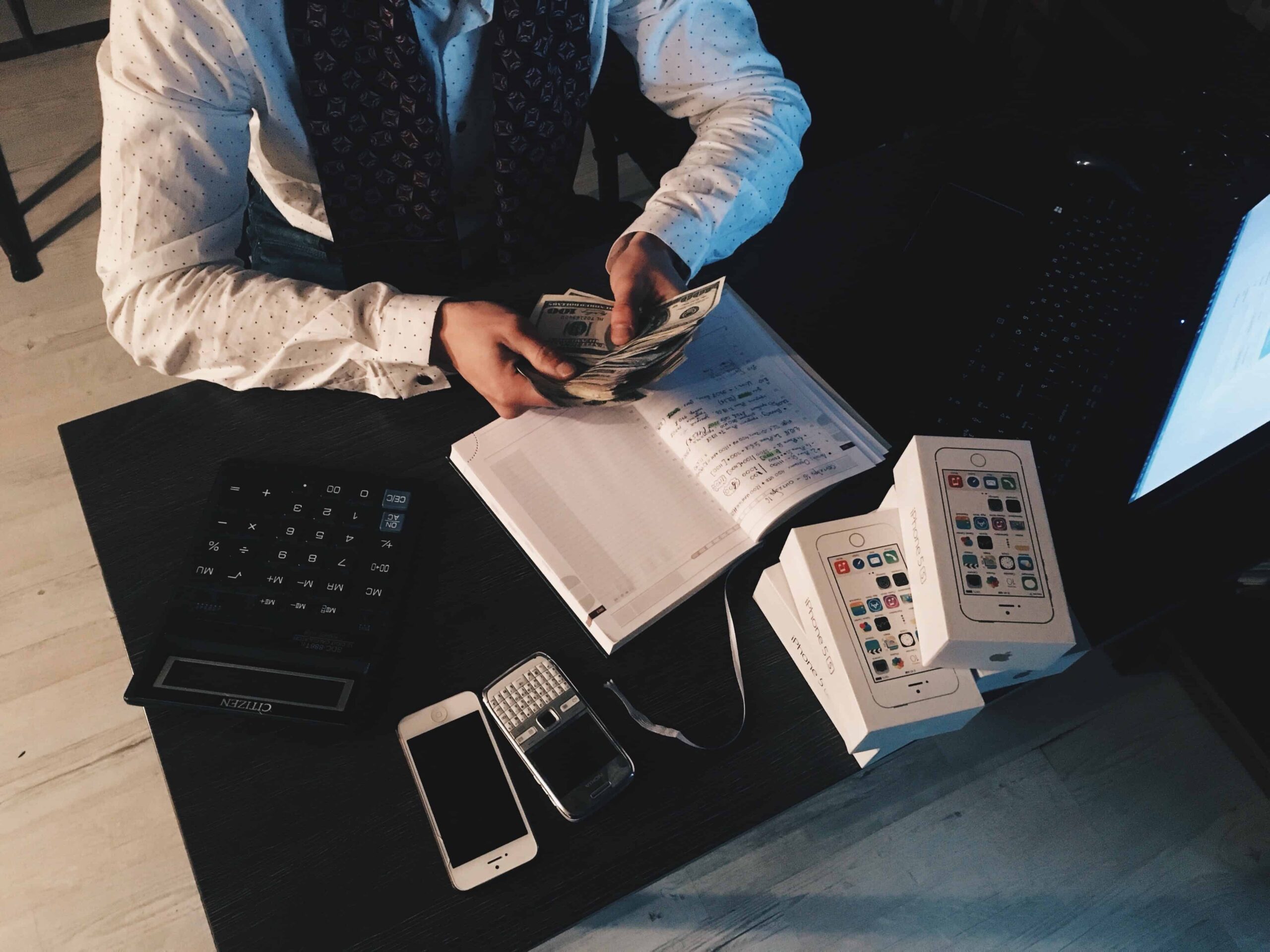

A Matter of Money

One of the most damaging aspects of this global pandemic is its effect on the economy. Businesses large and small have lost a ton of foot traffic, while the many months of shutdowns have resulted in losses in earnings. Right now, earnings are down, employers are cutting costs, and workers are finding it very difficult to make ends meet. A majority of civilians now find themselves without a job, while the risk of insane hospital expenses loom in the horizon. Even those who saved for rainy days are having a difficult time making it. The Coronavirus pandemic has lasted for over half a year and with no signs of ending.

The question now becomes, will your savings outlast the pandemic?

A Matter of Planning

One of the most important things to do right now is to be proactive when it comes to your financial situation. Instead of simply going through the motions or giving into impulses, you have to make sure your funds can outlast this pandemic. This means setting a solid, defined budget and sticking to it – no matter what. Cutting out extra expenses is also necessary to ensure that your bank account remains afloat.

With all this free time at home, it is very easy to give in to impulses. Online shopping, takeout food delivery, or even added expenses such as game subscriptions can be a problem. Without proper impulse control, you may find yourself having plenty of things to pay at the end of the month. Planning out your expenses and laying out how long can your savings last is a great start to financial security.

Calculating Ahead

For those who do not know where to begin, finding help is also a possibility. Plenty of sites online can help with financial planning, while others can offer methods to calculate potential savings and expenses. For example, using these calculators you can plan for the month’s budgeting, anticipate home loans, mortgages, monitor savings, and even plan retirement funds. The various calculators at Pigly.com offer something relevant for every consumer – all you have to do is look.

Planning ahead may not seem like much – all you do is theorize on potential expenses and savings. However, this is a great first step, one that gives you awareness of the potentially overwhelming problem during these troubled times. Without financial security, life will be a difficult journey through the next few years. Until the world recovers economically from this Coronavirus pandemic, it would appear that you are on your own. Being financially independent is a key to surviving this rough period in our history.

Now all that is left is to make sure you stick with budgeting and hope for the best.